Our recently-released Google My Business Insights Study took 45,000 GMB profiles across 36 industries and analyzed their Insights to see which industries were outperforming others.

Following on from our deep dive into car dealerships’ exceptional performance in Google My Business, it’s time to take a good look at the other big winners in the field, namely businesses in the hospitality industry.

By ‘hospitality industry’, in this article I’m specifically referring to:

- Hotels and B&Bs (‘Hotels’ in this piece)

- Restaurants and Cafés (‘Restaurants’)

- Bars and Pubs (‘Bars’)

Spoiler Alert: These three verticals are absolutely dominating local search and GMB (and hotels are doing particularly well). There are plenty of reasons for this outside good website and GMB optimization, which I’ll come to, but it’s undoubtable that making a concerted effort in these areas has played its part.

Direct and Discovery Searches for Hospitality Businesses

For those of you new to GMB Insights terminology, here are some definitions, straight from Google:

Direct search: A customer directly searched for your business name or address in Google search or Google Maps

Discovery search: A customer used Google search or Google Maps to search for a category, product, or service that you offer, and your listing appeared.

The table below shows how many direct and discovery searches the average business in each industry appeared in per month (sorted by the top 5 industries).

As you can see, there’s a strong trend of hotels, restaurants, and bars beating out the competition in search. But before we raise a glass to these behemoths of GMB, there are some important things to note.

We’ve shown in our own prior research that bars, restaurants, and hotels are the business types most likely to have reviews on their Google My Business Listings. In that study, we found that 99% of bars had reviews, 99% of restaurants had reviews, and 98% of hotels had reviews.

When you consider that review signals are considered the third most important to local rankings (according to a 2018 study by Moz), it becomes clear that the hospitality industry as a whole has a strong focus on generating reviews, which leads to fewer businesses standing out therefore a broader distribution in the local pack for discovery searches.

It’s also worth noting that just yesterday it was reported that Google is now asking for more detail in your hotel reviews (to supplant the data once supplied by TrustYou), suggesting that hotels will need to up their review game even further to compete.

Looking at the comparison between the three verticals directly, we get an impression of hotels absolutely dominating the space. One crucial caveat to this is that local search results for hotels are vastly different to results for almost every other business type. The completely unique hotel finder in Google search results present, just for starters, four listings results rather the standard three.

However, even factoring in the 33.3% increase in local pack results for hotels, they’re still beating out their closest competition, restaurants, by a margin of 52%. What can we attribute this to? Well, funnily enough, attributes!

Hotels (and to a slightly lesser extent, restaurants) can be high-cost and tend to require a lot more research when consumers are deciding where to go. This means that people naturally browse on Google for longer, opening the ‘View X hotels’ tab and generally clicking around a lot more.

While searches for restaurants can bring up small, clickable attributes like ‘Open now’, ‘Italian’, ‘Top-rated’, and ‘Within 0.5 miles’ that encourage filtering of results and further browsing, the way comparable attributes appear in searches for restaurants is very different.

These large, clearly expandable links to attribute filters come with colorful icons and dominate the upper search of the hotels local pack. The presence of these links, which scream ‘keep browsing’, can be placed alongside the reasons above for an explanation of hotels’ dominance in discovery searches.

All this serves to highlight how important it is not just to make sure your customers leave you reviews featuring relevant keywords and approve attribute suggestions when they’re offered up, but to keep investing in content that brings these attribute keywords to the fore. BrightLocal can help you to understand how your hotel, bar or restaurant is performing in rankings for keywords like these.

Views on Search and Views on Maps for Hospitality Businesses

Again, just so there’s no room for doubt, here’s what Google means when it says ‘Views on Search’ and ‘Views on Maps’ within Google My Business Insights:

View on Search: A customer found the business via Google Search, including local pack results from search.

View on Maps: A customer found the business via Google Maps.

The table below shows how many Search Views and Maps Views the average business in each industry received per month (sorted by the top 5 industries).

Again we see hotels and restaurants very much ruling the roost, with bars following not far behind. Still, hotels are a clear leader in this area. We can again point to the added functionalities that hotels receive in search as a potential explainer for this. Whether you search for a hotel via Google search or Google Maps, you’ll be presented by a variety of options to filter your results and carry on browsing.

Throughout the original study, we found that Views on Maps were higher than we had expected compared to Views on Search, but almost* nowhere was this more true than in the hospitality arena.

Here’s how the split looks for the three business types:

- Hotels and B&Bs: 53% Maps / 47% Search

- Restaurants and Cafés: 46% Maps / 54% Search

- Bars and Pubs: 48% Maps / 52% Search

I’ve already covered why we think hotels get so many more views overall compared to the other two business types, so let’s talk about why the percentage of views on maps is so high for hotels.

One factor is location. Apart from the general town, city or area, it’s not often really that important where a bar or restaurant is in relation to nearby facilities like transport hubs, venues, and main roads. When looking for a hotel, however, location is everything, and you’ll want to survey the nearby landscape of each one before making your decision.

Google Maps is by far the easiest way to assess the area around a hotel for suitability. Is it near the concert hall you’re going to in the evening? Can you get a taxi nearby? Is it near the train station? Will you get a good night’s rest if it’s near a busy intersection or a motorway? These are all things we consider when researching hotels, and Google Maps is the place to do it.

Another factor is direction requests, which are much more naturally accessed via Google Maps. As you’re more likely to be looking for a hotel in an area you’re unfamiliar with, Google Maps will be your go-to for finding out how to get there, even if it’s just from the nearest train station or bus stop.

This ties in with the GMB Insights of hotels reporting far greater direction requests than other businesses, which I’ll be covering in more detail later.

*I say ‘almost’ here because senior living businesses had a higher ratio of Views on Maps (63%) to Views on Search (37%) than hotels – that’s a lot of family members looking for directions to visit their elders!

Customer Actions for Hospitality Businesses

Unlike the previous GMB Insights metrics, customer actions are fairly self-explanatory: website visits, calls, and direction requests are all the result of a searcher clicking on one of these buttons within a Google My Business listing, be that on the knowledge panel, the local pack or the local finder in Google Maps.

The table below shows how many direction requests, calls, and website visits the average business in each industry received per month (sorted by the top 5 industries).

Although in this area there’s clearly a bit more room at the top for other industries, the story is broadly the same. Hospitality businesses get a ton of customer actions through their GMB listings.

But here we see one wrinkle in the performance pattern of “hotels, then restaurants, then bars”. For the first time in this study, restaurants outperform the other two in a key metric: calls (beaten only by car dealerships).

The propensity of searchers to call restaurants to make enquiries or bookings tells us just how far the restaurant industry has to go to convince the average diner to use online booking services.

It’s not like Google is shy when it comes to highlighting this function in GMB listings, either. It’s always pushing for more partners to join its Reserve with Google programme, and for consumers to be more aware of what they can do with the feature.

(However, the Google My Business Insights Study looks at interactions from Sept 2017 – Dec 2018, so I acknowledge that online reservations could have increased since that time, especially with Reserve With Google’s ongoing increase in sophistication.)

A counter-argument, though, is that restaurants are willingly forgoing online reservations as many of them come with a hefty commission. If the cost to your business of taking a phone call and filling up a bookings calendar is manual, why would you waste money on commission for online reservations?

Another key takeaway from the above chart is that direction requests are a key driver (no pun intended) of further interactions with hotels. In terms of the percentage of all customer actions comprised of direction requests, hotels (42%) were only beaten by senior living facilities (46%).

This suggests that the upgraded direction requests heatmap in GMB Insights would be a very valuable source of consumer data for hotels. Hoteliers should be looking at this heatmap very closely and considering upping or introducing marketing spend focused on the neighborhoods that these requests originate from.

It should be noted just how much the hospitality industry is dominating in terms of customer actions: the average business in the study received 59 customer actions per month, while the averages for hotels, restaurants, and bars were 711, 398, and 189, respectively.

Photo Quantity in GMB for Hospitality Businesses

It goes without saying that bars, restaurants, and hotels are the most photographed business locations in GMB (but we proved as much in the original study, if you’re interested). They are geared to look good. Even before Instagram, it was key that your venue looked inviting and appealing.

Nowadays, though, with the emergence of user reviews, social media, and user-generated content, the image of your hospitality business is firmly in the hand of the smartphone-wielder. This is borne out by the immense number of photos found on GMB listings for these types of businesses, detailed in the averages below.

Although our data doesn’t differentiate on how many photos were uploaded by the businesses and how many were from customers, I think it’s fair to say that it’s unlikely that many hotels upload over 100 photos of their premises, meaning that there’s immense pressure to get your hospitality business photographed as often as possible to compete in this metric.

Google Local Guides will be playing a huge part in the high numbers of images. They’re prompted by Google to post a photo whenever they visit a bar, restaurant or hotel so it’s likely second nature for them to take photos for both GMB and social media.

Some exclusive data cuts we put together for Search Engine Land proves just how important it is to compete with images, too. We found that although we can’t prove causation, there’s a huge correlation between the number of images a GMB listing has and the number of views and customer actions it gets.

The bottom line: make your dishes, your rooms, your venue, your bar, and your drinks Insta-worthy and they’ll naturally be GMB-worthy, too. It only makes sense that you’d want to always look your best, and this is yet another incentive to do so.

Time and Day of Calls to Hospitality Businesses

As part of our study, we looked at the most popular times of day and days of weeks for calls from GMB listings to hospitality businesses. While I’m not recommending you suddenly start opening an hour earlier to take advantage of these times, it’s definitely interesting to note how the three business types in this data cut compare.

While hotels and bars receive calls at similar times of day, call to restaurants skew way into the evenings. In fact, 42% of all calls to restaurants from GMB happen between 5pm and 7pm.

Bearing in mind that many businesses categorized as restaurants also serve lunch, it just serves to show how dedicated to answering customer service calls restaurants need to be during these hours.

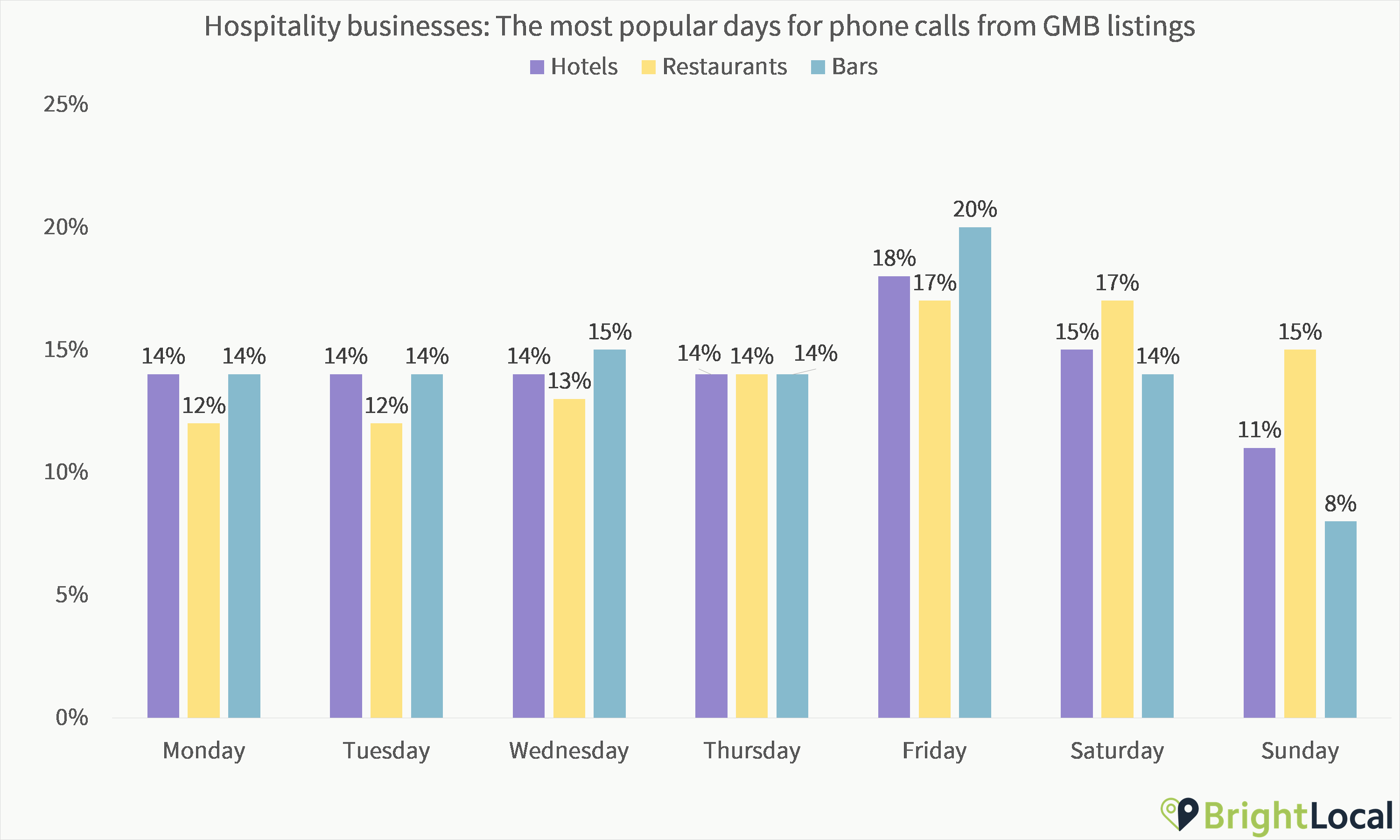

And finally, a chart that needs very little analysis. People call bars from GMB listings on Fridays more than the rest of the week and aren’t as busy on Sundays. Calls to restaurants are fairly consistent throughout the week but a little higher at the weekend. Hotels get busy on Fridays then less so throughout the weekend. These are things we probably could have guessed.

But hang on… what’s this?!

Bars receive more calls from GMB on Wednesdays (15% of all calls) than Saturdays (14%)?

That’s it, I’m calling it: Wednesday night is the new Saturday night. Bring on the post-humpday hangover.

Conclusion

With this deep dive into the Google My Business performance of businesses in the hospitality industry, I hope I’ve shown you that there are good, logical reasons for these businesses to dominate local search as much as they do.

If you’re working with a business like this, take a look at their GMB Insights and compare them to the industry averages shown above. If you’re helping them nail it, send them these stats and pat yourself on the back for a job well done.

If not, you know what to do.