During times of wider economic turbulence, you’d be forgiven for burying your head in the day-to-day running (and survival) of your business without coming up for air. So, it can be hard to get a read on how others in your industry are doing. If you’re feeling the pinch, are they? If you’re not feeling the pinch, should you be reassured—or worried—you’re missing something? Well, the good news is that we’ve done the research for you.

We surveyed over 400 BrightLocal customers, from small local businesses and marketing consultants to multi-location businesses and agencies, to gauge confidence within the local SEO space going into 2023, and to better understand some of the key challenges they’re frequently coming up against.

Spoiler Alert: the even better news is that, as you’ll see below, business leaders are feeling pretty positive.

Key Findings

- Across the board, 90% of marketers feel optimistic about their business health over the next 12 months.

- 76% of marketing agencies and consultants indicate that they will look to introduce new services.

- Over half of agencies and consultants are planning on increasing the price of services over the next 12 months.

- 54% of small and multi-location businesses plan to increase their marketing budgets in the next 12 months, as a result of inflation.

- 33% of agencies, freelancers, and consultants are finding it harder to win new business due to inflation and concerns about a recession.

- As well as reporting fewer new and lower quality leads, consultants and agencies are finding that new or prospective clients are currently more price-conscious and apprehensive to commit.

Business Health and Optimism Is Strong

Perhaps the key headline of this research is the striking sentiment that 90% of respondents feel either somewhat or very positive about their business health in the next 12 months. You can see the breakdown by business type in the chart and table below. While confidence levels vary somewhat between different business types—notably smaller businesses and independent consultants—you’ll note the optimism flows across the board.

| Very optimistic | Somewhat optimistic | Somewhat pessimistic | Very pessimistic | Not sure |

|

|---|---|---|---|---|---|

| Multi-location businesses | 70% | 24% | N/A | 3% | 3% |

| Marketing agencies | 55% | 37% | 5% | 1% | 2% |

| Small businesses | 56% | 31% | 7% | 2% | 6% |

| Freelancers and consultants | 34% | 53% | 6% | 2% | 5% |

Industry-wide, it feels like businesses of all types are taking the challenges of inflation, and threats of a recession in the last year, in their stride.

By seeking opportunities to diversify, and adapting to continually evolving changes in consumer behavior, businesses will be better placed to meet customers’ needs. Naturally, one of the key solutions for being better able to meet your customers’ needs is looking to introduce new services.

We found that over three-quarters of consultants and agencies are looking to introduce new services within the next 12 months, as a result of the upheaval inflation has brought about.

It is interesting, however, to look back throughout 2022 at separate reports on the subject of business optimism. The results have shown plenty of fluctuation up until this point:

- The Small Business Optimism Index (by the NFIB), reported a decline in October 2022, having previously seen steady rises for four consecutive months.

- JPMorgan Chase’s Business Leaders Outlook Pulse survey notes that leaders of mid-sized businesses remain optimistic about their own organization’s performance (71%), even with only one in five feeling positive about the wider economy.

From findings in our own research, as well as the third-party reports mentioned above, we can see that while current factors in the wider economic environment do influence business optimism, they are not directly responsible for marketers’ feelings towards their own business health. The fact that 76% of consulting local SEOs plan on developing their service offerings reflects this optimism further.

Local Businesses Up Marketing Budgets Amid Inflation Turbulence

There is, then, a general sense of confidence, but how are service prices and marketing budgets changing?

While inflation fluctuations are part and parcel of life, at the time of writing, global inflation sits at some of, if not the highest levels in decades, squeezing consumer spending, upheaving supply chains, and driving up the costs of goods and general running costs for businesses.

It won’t come as a surprise then, that more than half of the agencies and consultants polled are looking to increase their prices in the next 12 months. This may result from businesses having avoided the inevitable thus far, as 2022 has already seen waves of businesses across the US and the UK reluctantly having to pass on increases to their customers.

As you’ll see below, it’s perhaps surprising to see that 54% of small to multi-location business customers actually plan on increasing marketing budgets (if they haven’t done so already), compared to just 13% that either have or will be looking to decrease their marketing budget in the next 12 months.

A significant learning for many within the first year of the pandemic—along with the uncertainty and changeable restrictions that came with it—was just how much consumers need local businesses, and how important local and broader SEO services are for businesses to survive.

So, in continuing to navigate the ongoing turbulence of a global outbreak, and coming face-to-face with new economic threats and political unrest, it would be logical to assume that businesses—from small and independently-owned businesses to large, multi-location organizations—now much more widely recognize marketing efforts as integral to business success instead of a “nice to have” and are reflecting this in their budgeting.

Agencies and Marketing Consultants Face New Business Challenges

Despite high levels of optimism across the board from different business types, there are challenges that will inevitably come from concerns around a recession.

We surveyed marketing agencies, freelancers, and consultants on the issues arising from inflation, and how they impact existing clients and new business alike.

This research highlights an interesting contrast in the challenges faced by agencies against how small and multi-location businesses plan on spending in marketing budgets going forward.

As discussed in the budgets and services analysis above, we’ve unearthed that over half of local businesses plan to increase their marketing spends. Yet, among agency and consultant respondents, 44% cited existing clients looking to spend less as a key challenge, with 33% also experiencing more difficulty in winning new business.

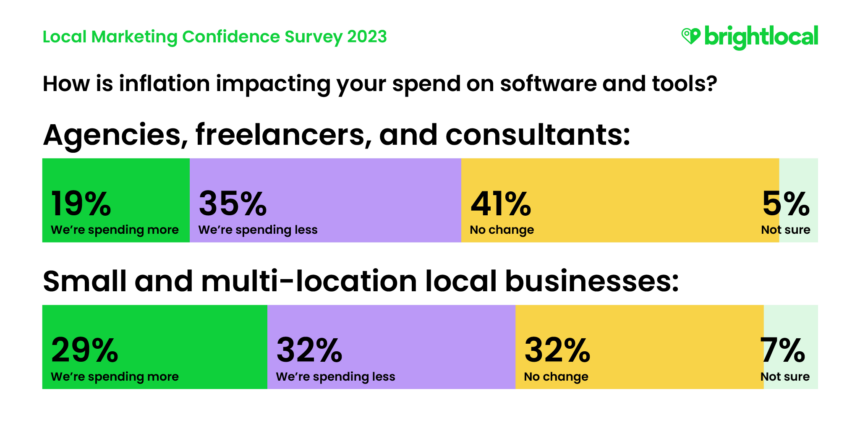

One possible way to explain this contrast is revealed by looking more closely at local businesses’ intentions for the year ahead: with almost a third of these spending more on software and business tools, it could be that they are considering taking some marketing services in-house, and factoring this into increased budgets as part of their growth plans or changing ambitions.

Additionally, what may suggest difficulty in winning new business, or hesitance towards long-term marketing commitments, could be a reflection of how many businesses are reconsidering pricing strategies and services moving into 2023, potentially pausing agency commitment.

We decided to explore these new business challenges even further, and presented five different areas to respondents, to see where agencies and consultants feel they are most affected (this is to be compared with experiences before the impact of inflation set in):

- price sensitivity of prospective clients

- length of time to commit to agencies

- quantity of new business leads

- new business win rate

- quality of new business leads.

While we identified the price sensitivity and lack of commitment from prospective clients as the joint leading concerns, you’ll see below that a significant proportion of marketing agencies, freelancers, and consultants have expressed each area of concern as affecting their ability to win new business.

The biggest takeaway from these circumstances? As a marketing professional, you need to ensure you’re providing your current clients with a strong reason to stay with you (and your expertise), and be sure to stand out from any competition when pitching to prospective clients.

The contrast in our findings also highlights an opportunity for agencies and freelancers to consider gaps in targeting, where local businesses have an appetite for investing in local SEO services. Could revisiting your targeting and positioning strategy highlight significant changes in customer behavior and potential new audiences? Or maybe you’re now in a better position to meet the needs of what had previously been a smaller customer segment?

Alternatively, there could be an appetite for additional general and local SEO services that have grown in importance and that consultants aren’t currently providing. So ensure you are continually thinking about how you can add value to your existing clients’ service and consider this in new business pitching.

On that note: Why not brush up on your local SEO prowess and discover some of the latest developments by enrolling in our expert-led Academy courses?

Summary

Despite ongoing fluctuations in economic optimism on a local, national and global scale, the Local Marketing Confidence Survey finds a strong sense of optimism towards business health, a sentiment that is reflected in other key business research from throughout 2022.

It seems there is an appetite across all business types and sizes to grow and diversify their offerings in 2023, which should act as a reminder—or a catalyst—to marketing professionals that it’s not enough to rely on how things have always been done until now.

As post-pandemic life and pressure from inflation continues to shape consumer behavior, remember that this, too, influences the needs and behaviors of businesses.

At BrightLocal, we’ll be continuing our research and analysis to provide leading insights into the world of Local SEO, kicking off 2023 with our 11th annual Local Consumer Review Survey. Do let us know if there is anything you’d like to see from us in the coming year down in the comments, or by getting in touch with our content team.

Methodology

The Local Marketing Confidence Survey was distributed to BrightLocal customers in September 2022 and received 417 responses. Of these respondents, 76% were located in the US, 9% in Canada, 9% in the UK, 4% in Australia, and 1% were categorized as ‘Other’.

Regarding business type, 61% of respondents represented agencies, 15% were marketing consultants/freelancers, 15% small businesses, and 9% multi-location businesses.

Publishers are welcome to use the charts and data, crediting BrightLocal and linking the URL of this research. Please leave a comment below if you have any questions, feedback, or observations about this survey.