About the BrightLocal Local SEO Industry Survey

The objective of this survey is to gain better understanding about the current state of the local SEO Industry. With this survey we hope to find out about life ‘on the ground’ for those in the local SEO industry, and also to share the research & findings publicly to help improve the knowledge and insight within our industry.

BrightLocal Local SEO Industry Survey 2014

This is the 3rd wave of the survey and was conducted in July / August 2014.

1,759 SEOs completed this year’s survey (up from 1,409 in 2013) and we thank them all for giving us their time & information to make this survey possible.

The survey asks questions specific to Local SEO and was promoted to the BrightLocal user base and our network of SEOs & agencies. We also received support from SearchEngineLand.com in promoting the survey so big thanks to the team there!

The majority of survey respondents are SEO freelancers, small digital agencies and web designers so the results are indicative of this audience.

We opted to update and change some of the questions asked in this edition. There are 19 questions which cover 5 key areas:

- Size & Turnover

- Clients & Industries

- Marketing & Sales

- Services & Tasks

- Future Outlook

We have made the following charts available for download as a PDF so that you can use them as a presentation in your reports. Download it here: Local SEO Industry Survey 2014.

Previous Surveys:

- 1st wave – July 2011 – /local-seo-industry-survey-2011

- 2nd wave – January 2013 – /2013/05/03/brightlocal-local-seo-industry-survey-2013/

Update – Important Disclaimer – 7th October 2014 :

Following the publication of the 2014 survey results it became apparent that there was some misunderstanding about the term “turnover” in relation to question 3: “What was your turnover in the last 12 months?“.

‘Turnover’ a is commonly used business term in the UK (where BrightLocal is located) and is an alternative term for a business’s ‘Revenue’.

However ‘Turnover’ is not commonly used in the USA and the mis-interpretation of the question by US-based participants may have led to some answering the question incorrectly.

Note – We have used the same terminology in the survey since 2011 and it has never been queried by the 3000+ participants & countless readers, so we were surprised & concerned when this issue came to light this year.

We run this survey to help those in the industry benchmark themselves against industry trends, and we want to make sure that the data reported in the survey is reliable & helpful to readers. To do this we re-surveyed all participants to find out 2 things:

a) Find out what their understanding of ‘Turnover’ was?

b) Ask them to restate their ‘Revenue’ for last 12 months?

In total 488 participants re-answered these additional questions. Approximately 50% correctly interpreted the meaning of ‘Turnover’ while 50% understood it to mean a variety of other things – e.g. Revenue lost from lost clients, Loss of Employees.

Given this sizeable mis-interpretation, the original results for Question 3 have been updated with the results from the re-run survey.

We sincerely apologize for the misunderstanding and will ensure that we double check all terms & terminology in the future.

Note to self, this book may help!

Size & Turnover Revenue

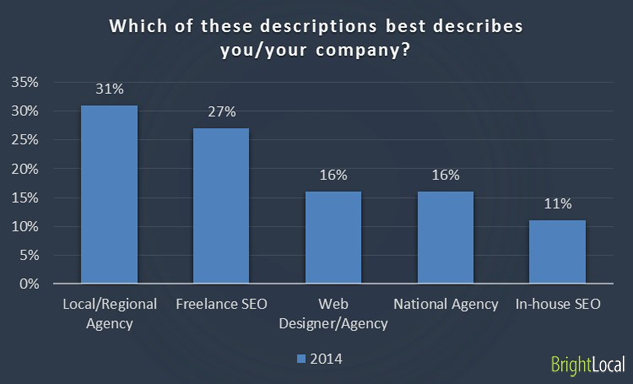

1. Which of these descriptions best describes you/your company?

This question sets the scene in helping us to understand our who our respondents are.

There is a healthy mix of respondents from different set-ups but the majority of those taking part are either local / regional agencies or freelance SEOs.

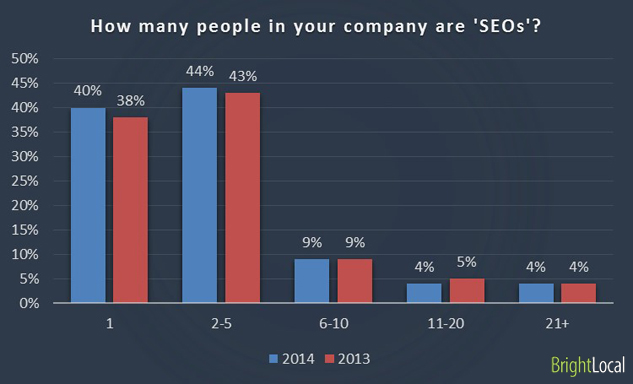

2. How many people in your company are ‘SEOs’?

Key Findings:

- 84% of those surveyed have 5 or less SEOs in their company

Analysis:

As we saw in the first question, the majority of respondents are local / regional agencies or freelance SEOs, so it’s unsurprising that 84% have just 1-5 SEOs in their business. We’ve compared the results to the responses from last years survey & can see that the results are very similar.

This shows that the majority of those working in local search do so as sole-traders or part of smaller agencies working within their immediate towns & counties. We see in later charts that income levels remain low for many in the industry, so the opportunity or practicalities for growth remain difficult for many of us. Obviously a % of SEOs choose to remain small & nimble and are not looking to grow into larger agencies.

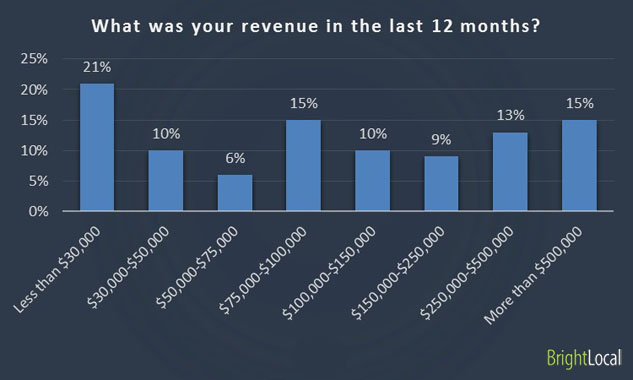

3.What was your turnover revenue in the last 12 months?

PLEASE NOTE: As per the disclaimer at the top of the page, it was our intention to measure company Revenue. However in the initial survey approximately 50% of respondents interpreted ‘turnover’ as a measure of other factors.’. Therefore we have recalculated the results based on the follow-up survey and removed any year on year comparison.

Key Findings:

- 21% of respondents revenue was less than $30,000

- 31% had revenues of less than $50,000

- 62% had revenues of more than $75,000

- 27% had revenues of more than $250,000

- 15% had revenues of more than $500,000

Analysis:

There is a spread of revenue levels from <$30k to $500k+ with agencies/consultants working at all levels.

One dramatic figure is that 1 in 5 local search consultants are earning less than $30k. This is quite an alarming figure as you would expect to be able to command higher fees & income given the complexity of the work & the potential impact it can have for a local business when done well.

Obviously the majority of our respondents are local / regional agencies or freelance SEOs and so you would expect the profit to be lower for smaller operations. However, 1 in 4 local SEOs also earn $75-$150k, whilst another 28% are earning more than $250k+, showing that there really is the potential to grow a consultancy into a larger operation in this industry.

Please note – P/T SEOs & ‘newbie’ SEOs would skew this figure as they are not operating at full capacity.

Clients & Industries

4. How many clients do you personally handle?

Key Findings:

- 33% handle 1-5 clients personally (vs 28% in 2013)

- 41% handle more than 10 clients personally (vs 41% in 2013)

- 24% handle more than 21 clients personally (vs 24% in 2013)

- The average local SEO deals with 9 clients (vs 11 in 2013)

Analysis:

Respondents are handling slightly less clients than last year, with the biggest shift moving from those handling 6-10 clients, to now handling 2-5 clients.

However, with 24% handling more than 21 clients, it adds up to an sizeable work load & tasks required each month. The key to running a successful local search business is efficiency and the ability to develop tools, processes & templates which can be followed for each client.

Hopefully tools like ours help to save time & take burden off hard working SEOs. While you can’t – and shouldn’t – automate all SEO tasks, we would advocate making use of available tools which allow you to focus on winning & working with clients, and tackling more critical SEO tasks.

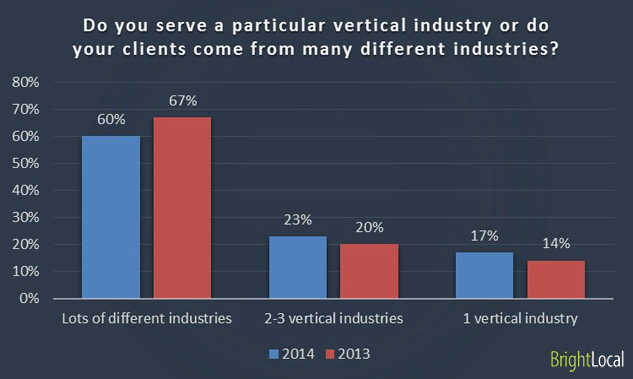

5. Do you serve a particular vertical industry or do your clients come from many different industries?

Key Findings:

- 60% serve lots of different industries (vs 67% in 2013)

- 23% serve 2-3 vertical industries (vs 20% in 2013)

- 17% serve 1 vertical industry (vs 14% in 2013)

Analysis:

There appears to be an increase in the number of SEOs targeting their efforts on clients in specific sets industries.

With staunch competition in the local search service market it certainly helps to have a specialism that allows a consultant/agency to demonstrate deeper understanding of a specific client’s business, industry & their own customers. Using the correct terminology & jargon related to an industry is more likely to resonate with a business owner and make them keen to work with you.

This specialism helps to –

- understand client’s needs better

- standout from other, less-focused agencies

- convert more customers

- charge higher fees

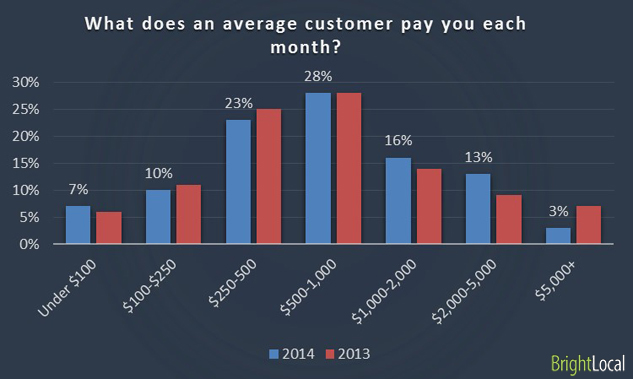

6. What does an average customer pay you each month?

Key Findings:

- 40% charge under $500/month

- 68% charge under $1,000/month

- 32% charge over $1,000/month

- Arithmetic mean charge is $1,020/month (vs $1,085 in 2013)

Analysis:

We can see that the income per customer varies quite a lot. Interestingly there are more clients paying less than $100 per month than there are clients paying more than $5,000 per month, and those paying over $5,000/month have dropped from 7% to just 3% since 2013.

So the average that customers spend appears to have dropped by $65 year on year (a 6% fall). Again this is a worrying sign for the industry as could mean a devaluing of the service by customers or fierce price competitiveness driving down what we charge.

Of course the type, depth and level of services provided will dictate the price point, as well as the size of the client company. Smaller SMBs will obviously have less marketing spend than a multi-location franchise business.

Marketing & Sales

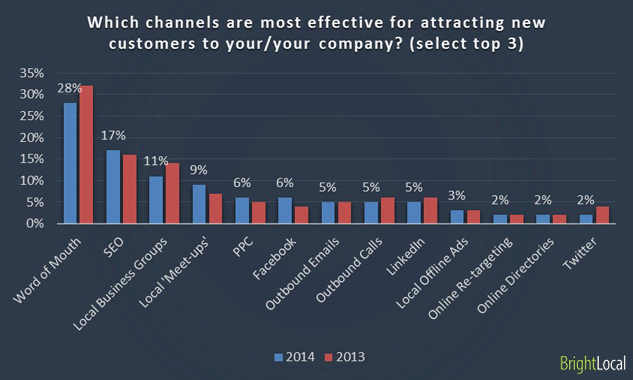

7. Which channels are most effective for attracting new customers to your/your company? (select top 3)

Key Findings:

- 28% say word of mouth is the most effective channel for attracting new customers

- 17% say SEO is most effective

- 11% say local business groups are most effective

Analysis:

It’s clear that a local SEO’s best tool for attracting new customers is it’s reputation. Whilst there are many channels available to attract new customers, 3 out of the top 4 are based on offline reputation & relationships.

SEO is also a big driver for local search consultants/agencies – that’s lucky! It helps to be able to demonstrate that if they can successfully get their own businesses ranking, then they stand a better chance of doing the same for their customers. SEO is also considered far more effective than PPC for generating leads.

The channels which have increased in perceived effectiveness year on year include SEO, Facebook & Local ‘meet-ups’ / workshops. However, social channels such as Facebook (6%), LinkedIn (5%) & Twitter (2%) are generally considered less effective as sales channels, but as we’ve seen before, these are probably more effective for communicating to existing customers rather than converting new ones.

8. How many new leads do you proactively contact each month? (via outbound emails & calls)

Key Findings:

- 27% do not contact any new leads each month (vs 32% in 2014)

- 27% contact 2-5 leads per month

- 75% are contacting less than 10 new leads/month

- 12% contact more than 50 new leads/month

Analysis:

In 2011 the amount of SEOs not approaching new leads was 46%. This fell to 32% in 2013 and now 27% in 2014.

Coupled to that we can see that 12% of respondents said they made over 50 sales calls/emails – up from just 5% in 2011.

This tells us that local SEOs are having to make more effort to win new business on a regular basis..

With most SEOs juggling multiple clients, (24% handle more than 21 clients personally) you would assume that they have their hands full, but this tells us that many are hungry for more business.

With the data we have it would be interesting to cross-examine some of the findings we’ve presented here. In a follow-up to this report, we’ll produce further insights into how company revenue relates to outbound lead generation, as well as how company revenue corresponds to the number of clients that a typical SEO looks after. This will allow us to draw further conclusions on the above.

9. What is your success rate at converting leads to customers?

Key Findings:

- 20% have a less than 10% success rate (vs 17% in 2013)

- 58% have a less than 50% success rate (vs 57% in 2013)

- Only 15% have a success rate of 80% or more (vs 14% in 2013)

Analysis:

With increased competition, winning new business becomes harder. Although there is not much of a difference year on year, there is a notable difference since 2011.

Hats off to the 1% that manage to convert 100% of their leads into customers! In 2011, 21% said they had a 100% hit rate but this has dwindled to just 1.

Once again, in follow-up to this report, we’ll look closely at how the number of outbound leads pursued by a company, compares to the average industry success rate.

Services & Tasks

10. What SEO/online marketing services do you offer? (select as many as you want)

Key Findings:

- Google+ optimization, on-site SEO & citation building are the most popular services offered

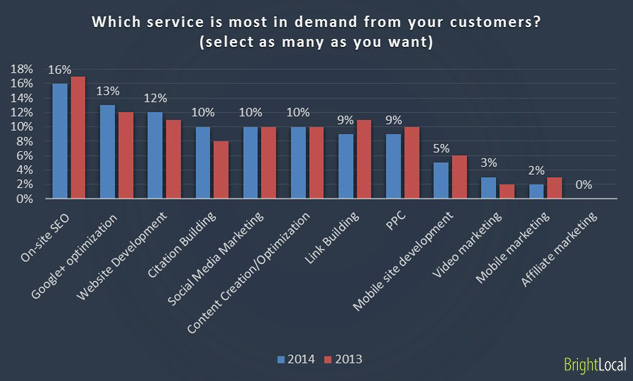

11. Which service is most in demand from your customers? (select as many as you want)

Key Findings:

- Video & mobile marketing are amongst the services offered least & with little demand

- Services seeing most increase in demand are: Google+ optimization, citation building & website marketing

Analysis:

The services which are offered by local SEOs generally match those services which are most in demand.

In most cases, and from what we have seen in our experience with talking to BrightLocal customers, the services offered by SEOs are driven by customer demand. Video & mobile marketing are both channels which are well discussed in the industry now, but perhaps SMBs are not as educated about their benefits – which opens up an educational opportunity for all you SEOs out there!

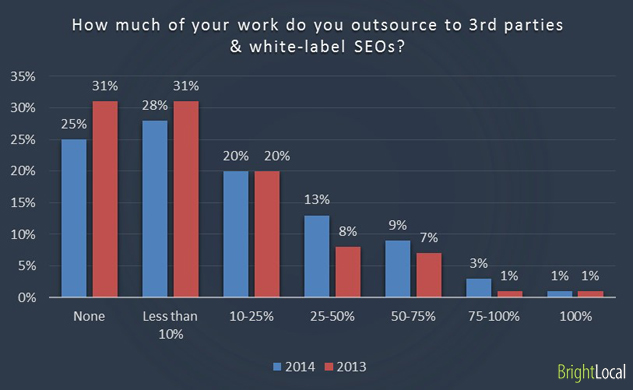

12. How much of your work do you outsource to 3rd parties & white-label SEOs?

Key Findings:

- 53% outsource less than 10% of their workload to 3rd parties (vs 62% in 2013)

- 13% outsource more than 50% of their workload (vs 9% in 2013)

- 26% outsource more than 25% of their work (vs 17% in 2013)

Analysis:

There is a slight increase in the amount of work that is outsourced to 3rd parties.

As SEOs take on more & more clients, this is an efficient way to handle the increased workload at reasonable & controllable cost. Many outsource services specialise in certain areas – e.g. link building – so can also be a very effective, as well as cost effective, option.

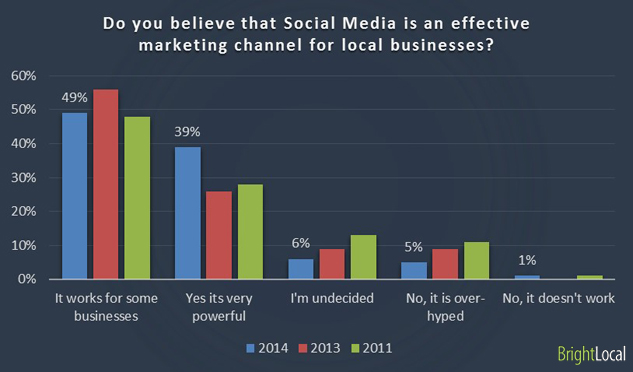

13. Do you believe that Social Media is an effective marketing channel for local businesses?

Key Findings:

- 88% believe that social media can have a positive effect on a local business (vs 82% in 2013)

- 12% are undecided or not convinced

Analysis:

In 2011, 76% were positive about social media for local businesses, in 2013 this increased to 82%. This year that has climbed to 88%.

There are more SEOs who believe that social media is a very powerful tool, and less who thought it worked for some businesses, which means that there is a general shift in feeling that it is becoming an essential channel for all local businesses, rather than a select few.

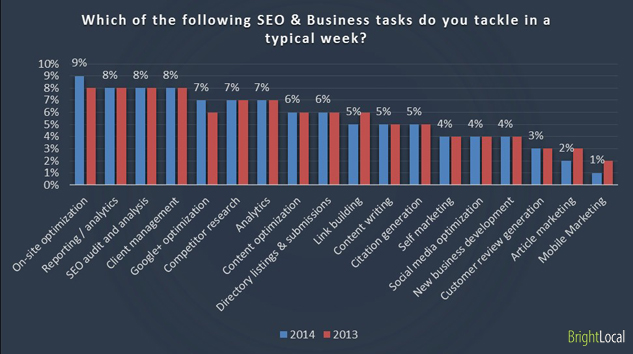

14. Which of the following SEO & Business tasks do you tackle in a typical week?

Key Findings:

- Onsite optimization, Reporting / analytics, SEO audits & client management are the most tackled tasks per week

- New business development can often be neglected in favour of existing client tasks

Analysis:

We can see the full array of a wide range of tasks undertaken by SEOs on a weekly basis. It’s becoming an increasingly complicated industry & those that are able to simplify tasks will surely prevail more often than those that become bogged down by reports & meetings.

We can see that there are tasks which could become potentially streamlined, and that reporting, however important can get in the way of the actual SEO work that is required.

Self-promotion tasks such a self marketing & new business are low down the list. With these tasks being critical to establishing a reputation & winning new customers we can start to see why 1 in 5 consultants/agencies are struggling to grow and earn more than $30,000 p.a.

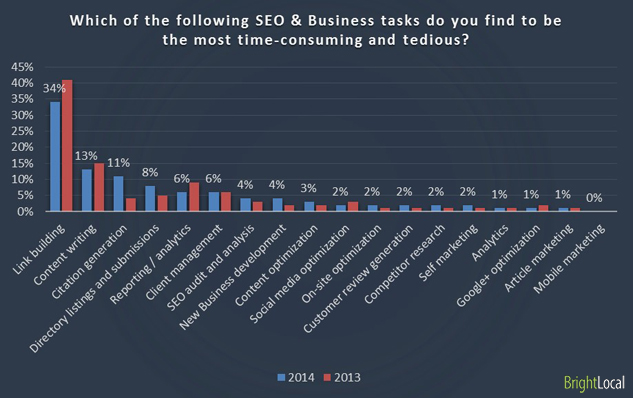

15. Which of the following SEO & Business tasks do you find to be the most time-consuming and tedious?

Key Findings:

- Link building, content writing & citation generation are considered the most time-consuming & tedious tasks

Analysis:

Interestingly, Google+ optimization & is considered one of the most in demand tasks – and also one of the most popular offered – and it is also a far less tedious & time consuming task than many of the others. That’s good news and the recent launch of Google MyBusiness coupled with ongoing improvements in verification & customer support are lowering the pain barriers of working with Google+ Local/MGB/Places (whatever you want to call it!!)

Link building was considered the most tedious task by 41% of SEOs in 2013, and 34% this year, perhaps suggesting that some SEOs have stopped doing / changed strategies in the wake of Google penalties?

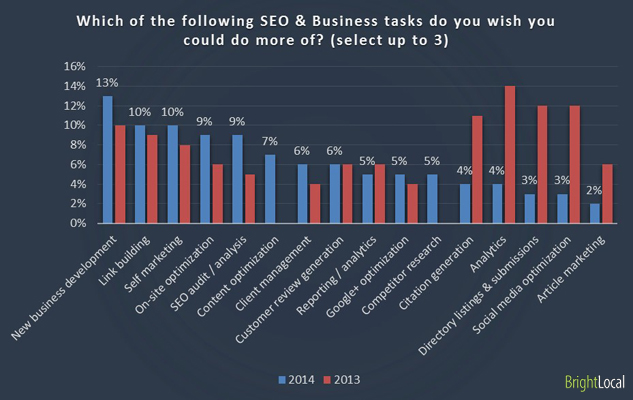

16. Which of the following SEO & Business tasks do you wish you could do more of? (select up to 3)

Key Findings:

- New business development is the number one task that SEOs wish they could do more of

- Link building, self marketing, on-site optimization & SEO audit / analysis are other popular choices

Analysis:

Link building is seen as a tedious task yet one that SEOs still wish they could do more of.

New business development goes hand in hand with growth & staff recruitment (more on this below) throughout the next 12 months so not surprising to see it high on the wishlist again. Unfortunately given the sheer work load undertaken by SEOs there isn’t much time left over for winning new business – it’s the catch 22 for growing from a 1 man consultancy into a larger agency!

It’s also interesting to see the amount of tasks that were so high on an SEOs wish list / agenda last year, but have since dropped in 2014. These include analytics, citation generation & social media optimization.

(Please note that some tasks are new additions to the 2014 survey).

Future Outlook

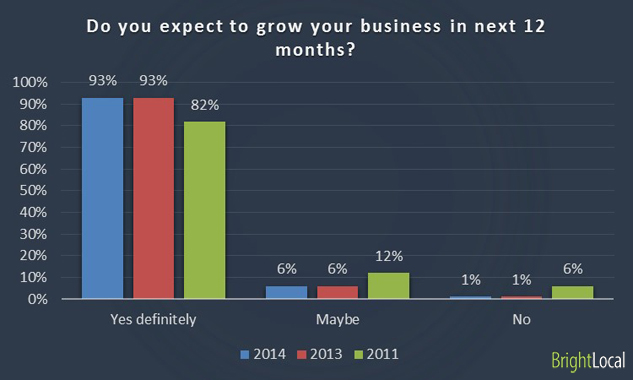

17. Do you expect to grow your business in next 12 months?

Key Findings:

- 93% definitely expect to grow their business in the next 12 months

Analysis:

There is a huge amount of optimism in the SEO industry with 93% of respondents expecting to grow their business in the next 12 months. The 2013 survey returned the same figure for the expected growth throughout 2014, but in 2011 the expectancy was a modest 82%.

With such optimism you could be forgiven for thinking it was plain sailing for SEOs in the next couple of years. But we’ve seen in earlier charts that income levels are falling, winning customers is becoming harder and customers are paying less. But it’s great to see that this isn’t dampening enthusiasm and outlook for so many of us.

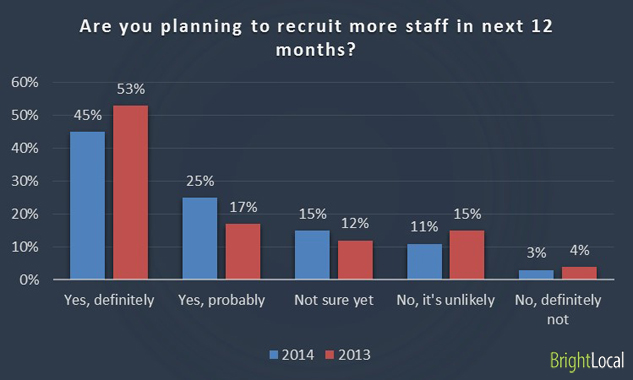

18. Are you planning to recruit more staff in next 12 months?

Key Findings:

- 70% have plans to recruit more staff in the next 12 months

- 14% are unlikely to recruit more staff in the next 12 months

Analysis:

More positive news for the industry with so many agencies looking to recruit.

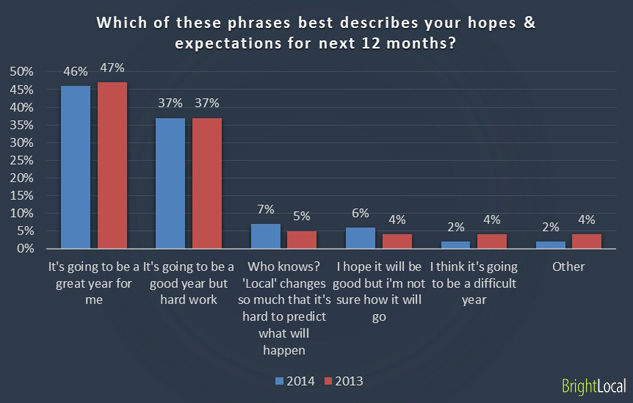

19. Which of these phrases best describes your hopes & expectations for next 12 months?

Key Findings:

- 83% believe it is going to be a ‘great’ or ‘good’ year

- 17% are a little less sure about the outlook

Analysis:

Despite the fact that SEOs are a little more hesitant this time around, with 45% definitely planning to recruit more staff vs 53% last year, there is still a very positive outlook on the horizon.

With such positive outlook and expectancy of growth in the SEO industry, more staff are sure to be required. More clients mean more work, and more work means more hands on deck. With such growth we are likely to see more and more ‘new to SEO’ staff enter the field in the next 12 months. This year, 10% said they were new to SEO, and that figure looks set to increase again in 2015.

We have also published a ‘further insights’ study that looks closer at the data & examines the relationship between types of business & other factors. See further insights from the Local SEO Industry Survey.